new market tax credit map 2020

31 2017 the CDFI Fund released updated 2011-2015 American Community Survey ACS low-income community LIC data for the New Markets Tax Credit NMTC program. Seven-year credit period for every dollar invested and designated as a QEI.

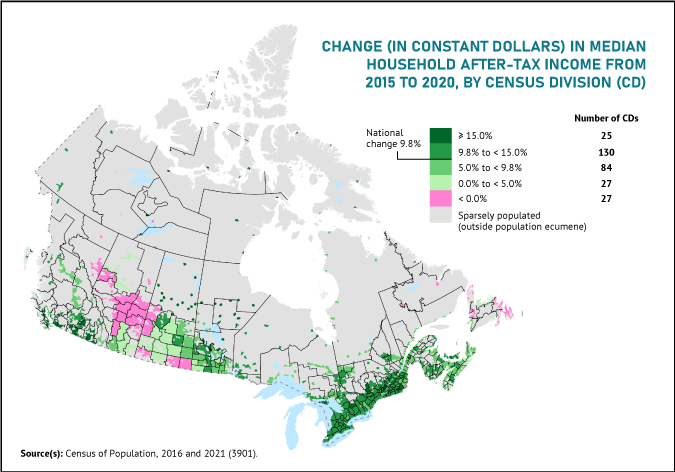

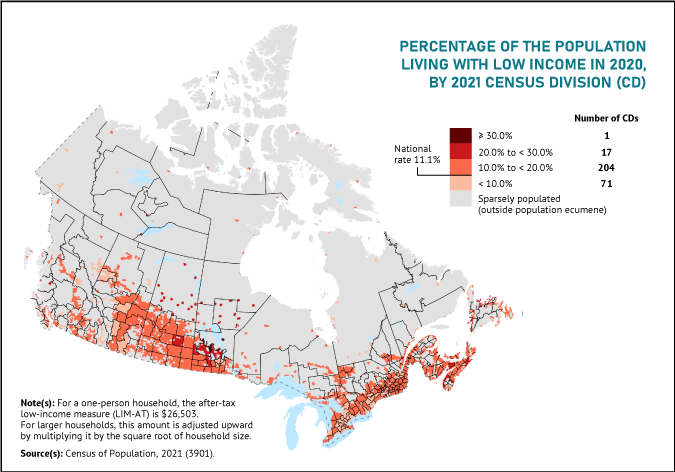

The Daily Pandemic Benefits Cushion Losses For Low Income Earners And Narrow Income Inequality After Tax Income Grows Across Canada Except In Alberta And Newfoundland And Labrador

Difficult Development Areas DDA are areas with high land construction and utility costs relative to the area median income and are based on.

. The New Markets Tax Credit NMTC was established in 2000. To help fill the gap left by shortfalls in fundraising from traditional sources nonprofit organizations can explore the New Markets Tax Credit NMTC program. The New Markets Tax Credit is taken over a 7-year period.

The new data can be used beginning Oct. The NMTC has supported more than 5300 projects in all 50 states the District of. Awards will Spur Economic and Community Development Nationwide WASHINGTON The US.

Department of the Treasurys Community Development Financial Institutions Fund CDFI Fund announced 5 billion in New Markets Tax Credits today that will spur investment and economic growth in low-income urban and rural communities nationwide. This mapping tool helps access eligibility using census-based criteria from the 2011-2015 and 2006-2010 American Community Surveys. A taxpayer may claim the NMTC for each applicable year by completing Form 8874 New Markets Credit and filing the form with the taxpayers federal income tax return.

Jun 30 2020 0801 ET. New Markets Tax Credit Investments In Our Nation S Communities As of the end of FY 2020 the NMTC Program has. Congress authorizes the amount of credit which the Treasury then allocates to qualified applicants.

The 5593-page Act provides 900 billion in coronavirus disease 2019 COVID-19 pandemic relief and 14 trillion in government funding for the rest of fiscal year 2021. Low-Income Housing Tax Credit Qualified Census Tracts must have 50 percent of households with incomes below 60 percent of the Area Median Gross Income AMGI or have a poverty rate of 25 percent or more. From 2003 through 2020 the program has parceled out credits worth 26 billion in 2020 dollars.

Your project may be eligible for the Program based on its location in a qualified census tract. When a user clicks on the map the info bubble displays values based on the 2011-2015 eligibility data. According to the Tax Policy Center thats 5 of the investment for each of the first three years and 6 of the project for the next four a total of 39 of the NMTC project.

The New Markets program is designed to encourage investments in low-income communities that traditionally have had poor access to debt and equity capital. On Sunday December 27 2020 President Trump signed into law the bipartisan Consolidated Appropriations Act 2021 Act. New Markets Tax Credit.

Manner of Claiming the New Markets Tax Credit. 275 mixed-use projects combining housing. From 2003 through 2020 the program has parceled out credits worth 26 billion in 2020 dollars.

In December 2019 the NMTC program was extended for an additional year and increased from 35 to 5 billion but the current round of awards which are expected to be announced in early. The New Markets Tax Credit Coalition 1155 15th Street NW Suite 400 Washington DC 20005 202-393-5225. Anderson said NMTC financing fills an approximately 20-30 gap in the capital stack of a project while.

Investors can claim these credits in as little as seven years. Included in the Act are many provisions for. The NMTC program provides a credit against federal income taxes of 39 over 7 years to taxpayers who make Qualified Equity Investments QEIs in a Community Development Entity CDE.

WASHINGTON June 30 2020 PRNewswire -- The New Markets Tax Credit Coalition today released its 2020 New. On July 15 2020 the Community Development Financial Institutions CDFI Fund announced the 16th round of the New Markets Tax Credit NMTC allocations. 31 2017 with a one-year transition period in which applicants can alternatively choose to use 2006-2010 data.

The CDFI Fund is an equal opportunity provider. WASHINGTON June 30 2020 PRNewswire -- The New Markets Tax Credit Coalition today released its 2020 New Markets Tax Credit NMTC Progress Report the sixteenth edition. Over the last 15 years the NMTC has proven to be an effective targeted and cost-efficient financing tool valued by businesses communities and investors.

Either census database may be used to evaluate eligibility through a transition period ending October 31 2018. WASHINGTON June 30 2020 PRNewswire -- The New Markets Tax Credit Coalition today released its 2020 New Markets Tax Credit NMTC Progress Repo. The New Markets Tax Credit NMTC was designed to increase the flow of capital to businesses and low income communities by providing a modest tax incentive to private investors.

The projected annual impact of 5 billion in New Markets Tax Credits includes an estimated 690 new manufacturing expansions and industrial projects. Seventy-six Community Development Entities CDEs received shares of 3548485000 in tax credit allocation authority. The NMTC allocation for the 2020 round is set at 5 billion in tax credit allocation authorityan increase of 15 billion over the 35 billion allocated in NMTCs initially authorized for 2019.

Enacted in 2000 to infuse investment dollars into low-income communities. The CDFI fund provided the allocation availability notice PDF 209 KB which is scheduled to be published in the Federal Register on September 23 2020. New Markets Tax Credit Program allocatees can make investments in all 50 states the District of Columbia Puerto Rico and certain US.

Business Council Of Alberta Bizcouncilab Twitter

New Cemetery Development City Of Hamilton Ontario Canada

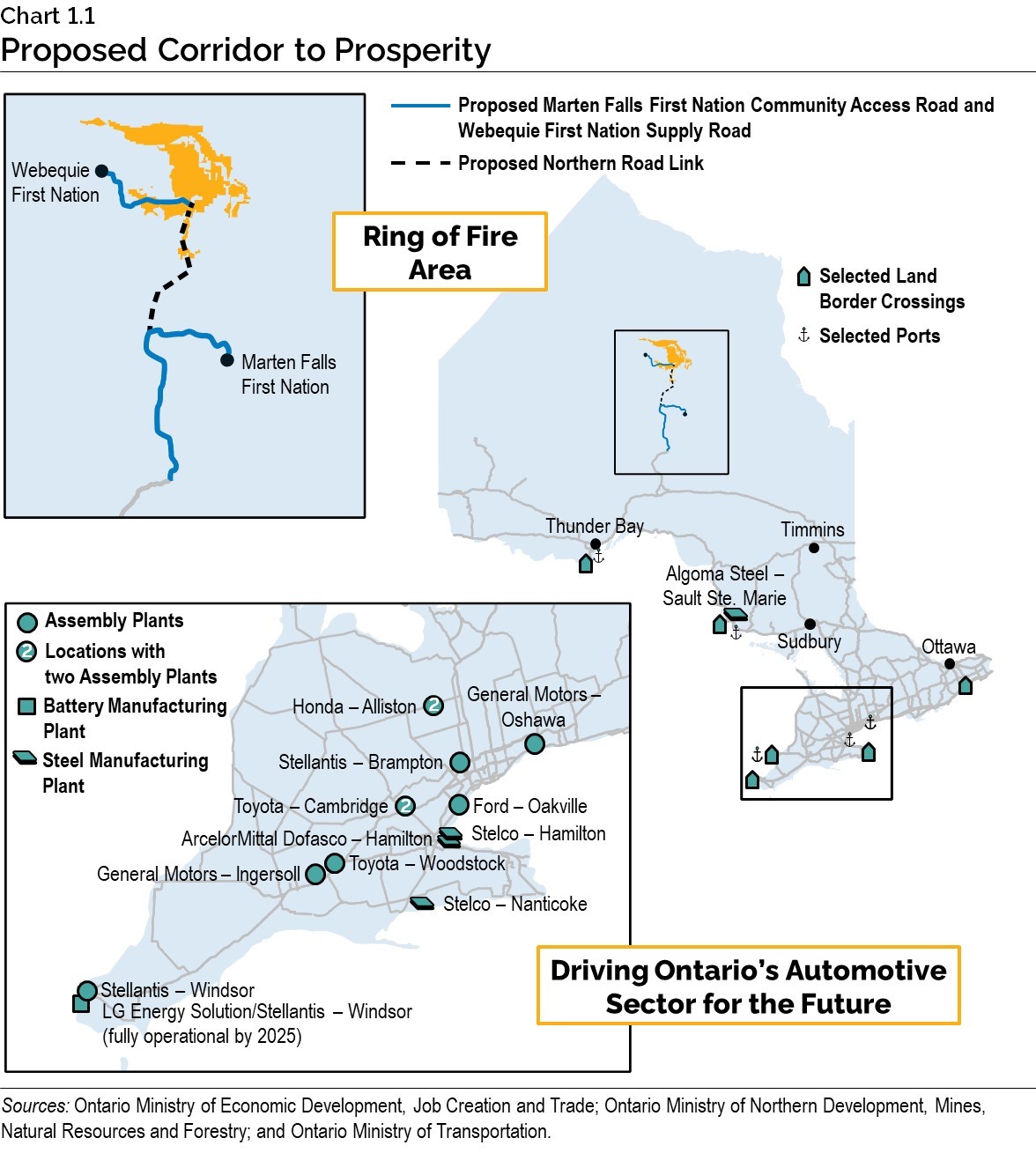

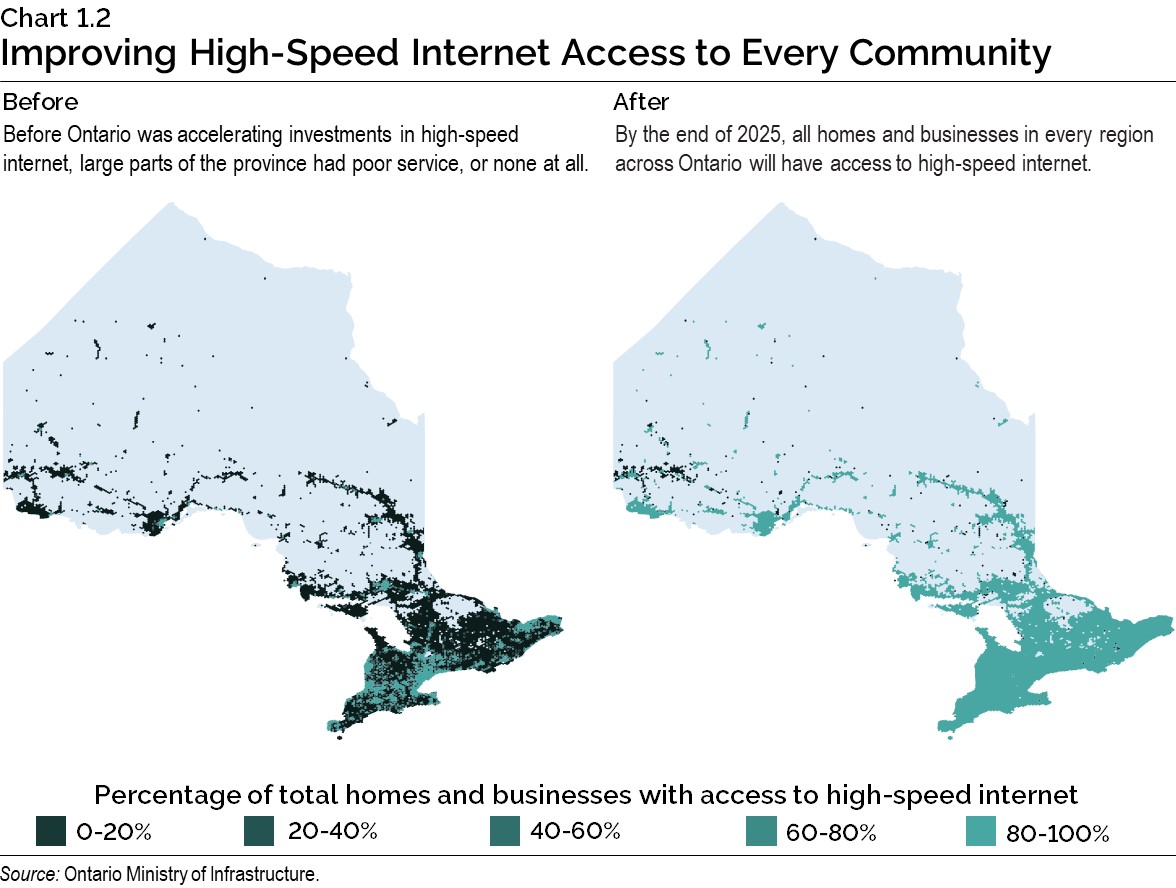

2022 Ontario Budget Chapter 1a

Usa Map For Kids Laminated United States Wall Chart Map 18 X 24 Amazon Ca Office Products

The Daily Pandemic Benefits Cushion Losses For Low Income Earners And Narrow Income Inequality After Tax Income Grows Across Canada Except In Alberta And Newfoundland And Labrador

New Markets Tax Credit Investments In Our Nation S Communities

Canadian Pacific And Kansas City Southern Agree To Combine To Create The First U S Mexico Canada Rail Network

Download Open Census Data Neighborhood Demographics

2020 Tax And Rate Budgets City Of Hamilton Ontario Canada

2022 Ontario Budget Chapter 1a

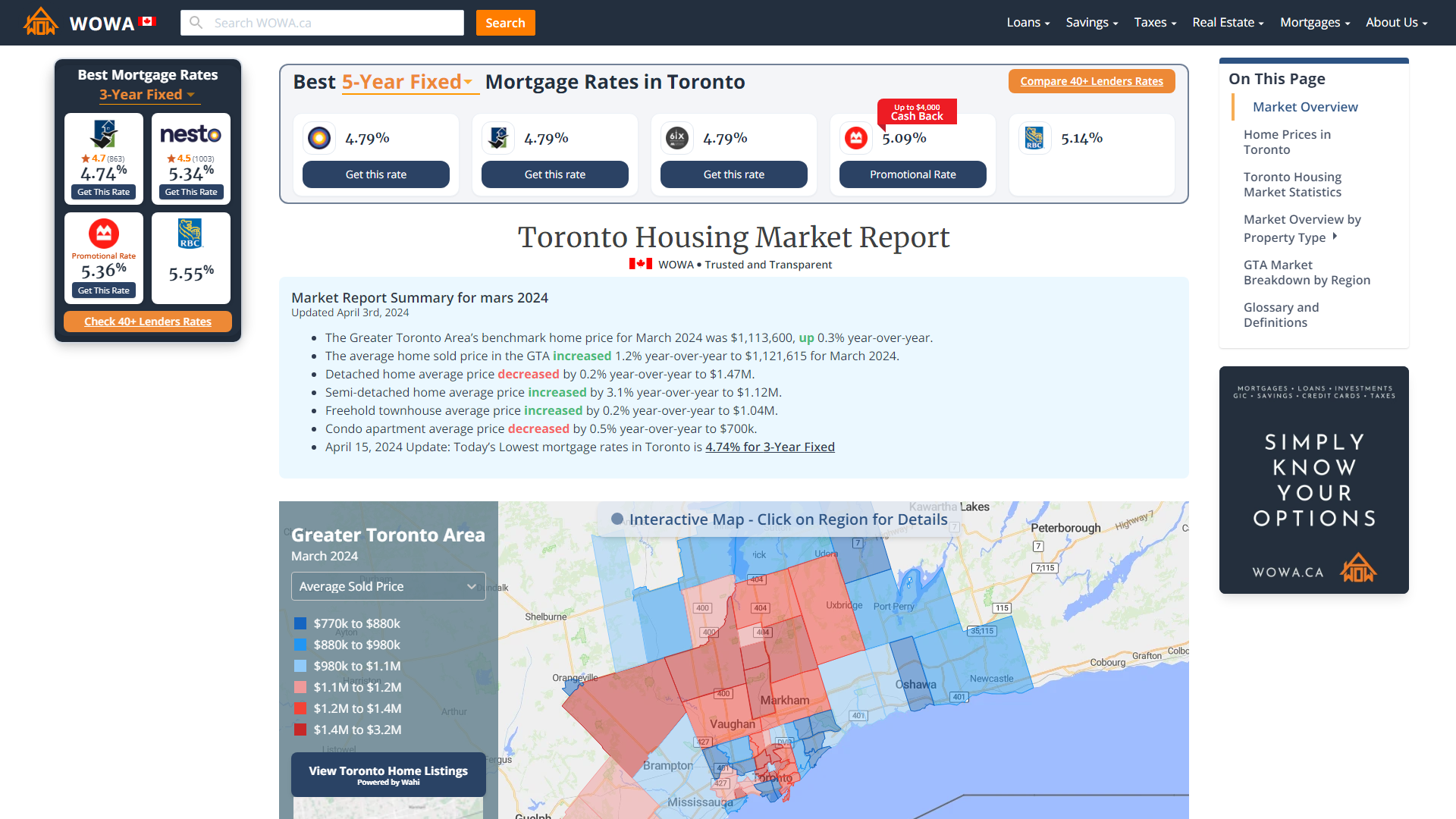

Toronto Housing Market Aug 5th 2022 Update Interactive Map Wowa Ca

New Markets Tax Credit Investments In Our Nation S Communities

New Markets Tax Credit Investments In Our Nation S Communities

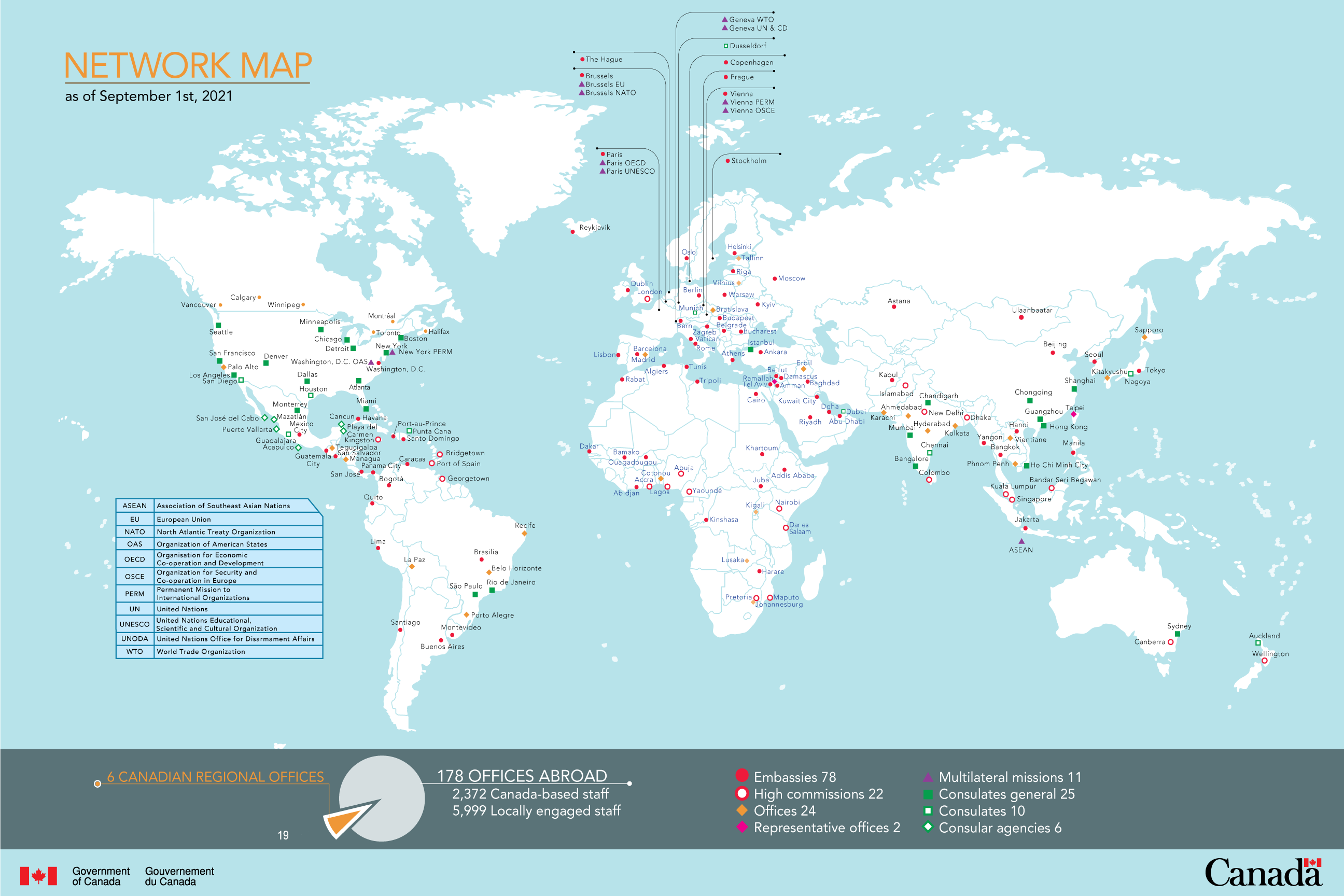

Minister Of Foreign Affairs Briefing Book

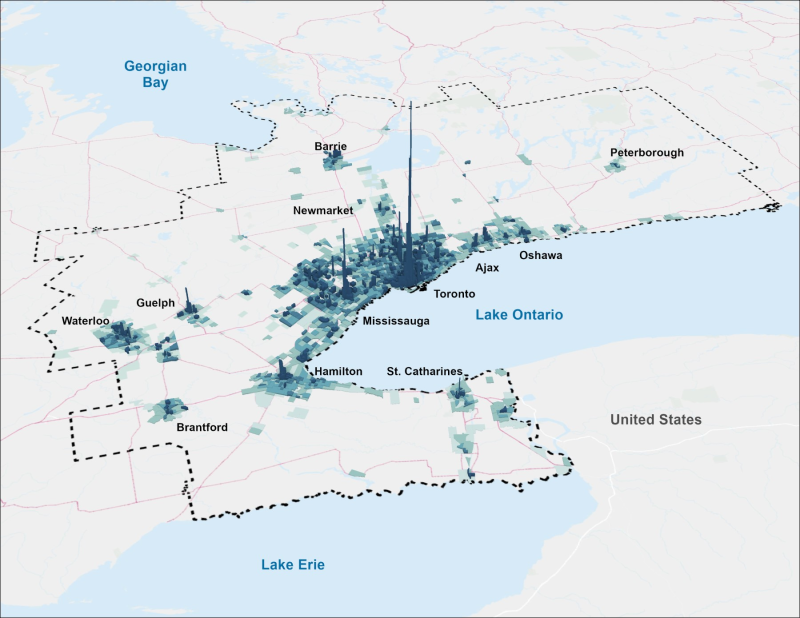

Connecting The Ggh A Transportation Plan For The Greater Golden Horseshoe Ontario Ca

New Markets Tax Credit Investments In Our Nation S Communities

A Year Of Mapping Media Impacts Of The Pandemic In Canada Covid 19 Media Impact Map For Canada Update March 11 2021 J Source